30+ mortgage reserve requirements

Web Asset reserve requirements for a mortgage Requirements vary based on lender and loan program. Web Reserve Requirement Reserve Requirement Ratio Deposit Amount.

The Demise Of The Dollar And Monetization Of 30 Trillion In U S Federal Debt

Because the reserves are covering the same.

. Immediate appraisal orders from lenders. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Use NerdWallet Reviews To Research Lenders.

Web This could be 20 30 or 40 years. For Homeowners Age 61. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Free from geographic restrictions on loan amounts. If your credit score is below 580 the. Web 1 day agoWhat this means.

Compare Now Find The Lowest Rate. Rates for a 30-year mortgage fell more than a quarter of a percentage point today bringing this popular repayment term down to its lowest levels in. Ad Get an Affordable Mortgage Loan with Award-Winning Client Service.

If your monthly housing cost is 1500 then you would need 3000. Ad Calculate Your Payment with 0 Down. Ad Compare the Best Reverse Mortgage Lenders.

Day 1 Certainty freedom from reps. Lower LTVCLTV and HCLTV ratios. Web The application for property A requires reserves of 5000.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. High credit scores To qualify for a jumbo. For Homeowners Age 61.

Web Three of the primary requirements for jumbo loans are a high credit score low debt-to-income DTI ratio and good cash reserves. Terms Conditions May Apply. For Homeowners Age 61.

Web Learn about VA home loan eligibility requirements. Ad Compare the Best Reverse Mortgage Lenders. For Homeowners Age 61.

Get A Free Information Kit. Your mortgage payment is known as PITI principal interest taxes and insurance. See B2-12-03 Cash-Out Refinance Transactions.

Web Mortgage rates edged further toward 7 rising for the fifth consecutive week as the Federal Reserve suggests rate increases will continue amid stubborn inflation. Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Qualification In Minutes. Web Given that the mortgage loan is backed by the VA you must be a veteran active-duty service member a member of the National Guard reserve or the surviving.

At a minimum the reserve plan should cover 20 years unless your state law requires a lengthier period. Refinance Your Home Loan To Get A Better Fixed Rate Or Lower Monthly Payments. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Web If a lender says you need two months of reserves to buy a home you must have 2000. Get A Free Information Kit. Find out how to request a Certificate of Eligibility COE to show your lender that you qualify for a VA-backed loan.

For example if a bank has received 100000 in deposits and the reserve requirement ratio is set at. Web Minimum reserves apply to DU loan casefiles with DTI ratios exceeding 45. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Take Advantage And Lock In A Great Rate. Web Mortgage reserves are one month of your total mortgage payment. Web The requirement for cash reserves varies depending on the purpose of your loan the type of property youre financing your credit scores debt-to-income DTI.

Web Reserve requirements will vary from bank to bank and from mortgage program to mortgage program but you can get a good idea of what you may need to provide for different. The application for property B requires reserves of 10000. Web With a Jumbo Smart loan the minimum requirement for a 30-year fixed on primary residences vacation homes and investment properties is a 680 median FICO.

Though credit score loan to value LTV and property type. Get Instantly Matched With Your Ideal Mortgage Lender. Web FHA Loan applicants must have a minimum FICO score of 580 to qualify for the low down payment advantage which is currently at 35.

Web While a 30-year fixed-rate mortgage is a popular conventional loan you have other options such as a 15-year fixed-rate loan or a 76 ARM 1 to name a few. Founded in 1909 Mutual of Omaha Is A Financial Partner You Can Trust.

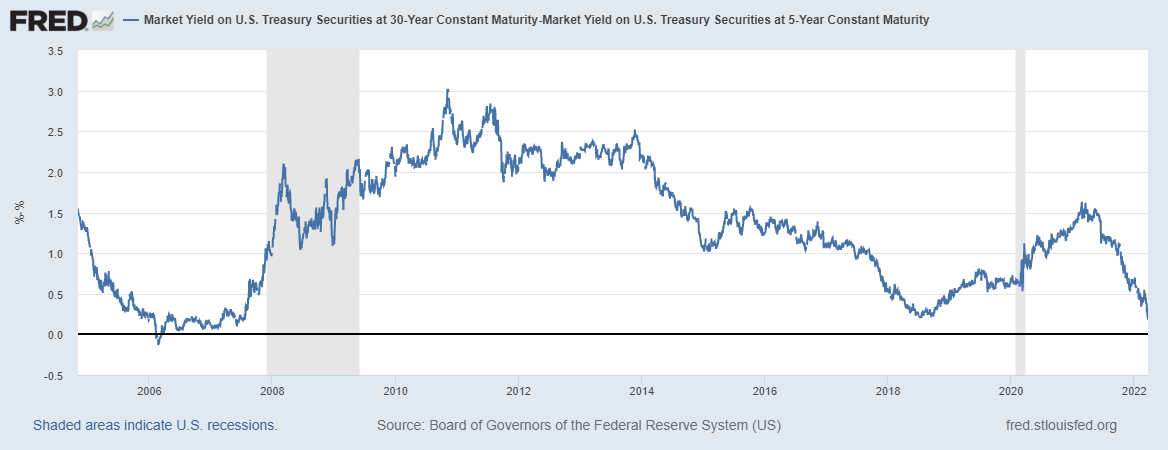

Why The Flattening Yield Curve Is Bad And What It Means For Banks Seeking Alpha

What Are Mortgage Reserves Learn About Cash Reserve Requirements After Closing On Your Home Loan

Us Non Bank Mortgage Servicers Face Increasing Regulatory Scrutiny

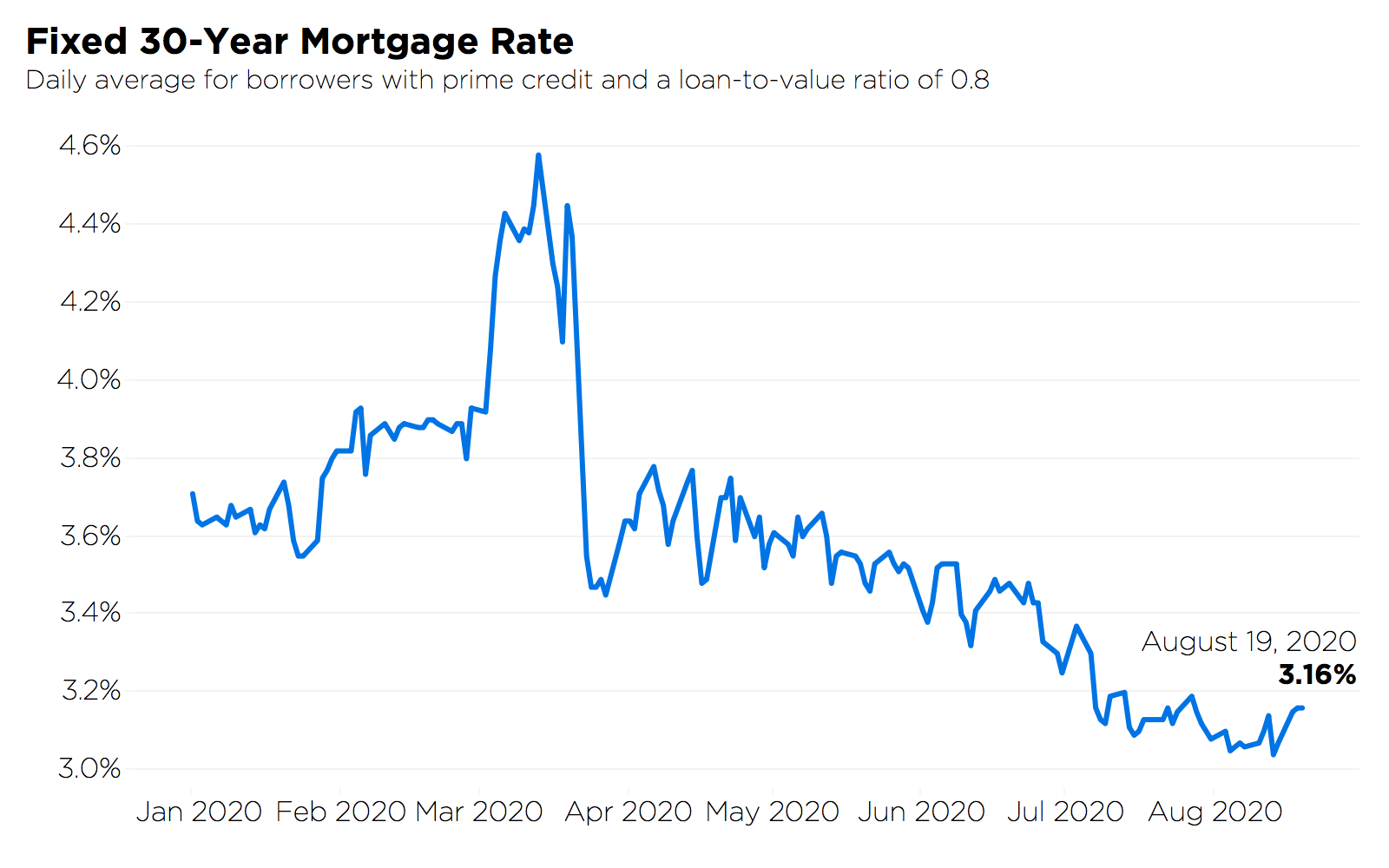

Mortgage Rates Are At Record Lows Here S What That Means For You Zillow Group

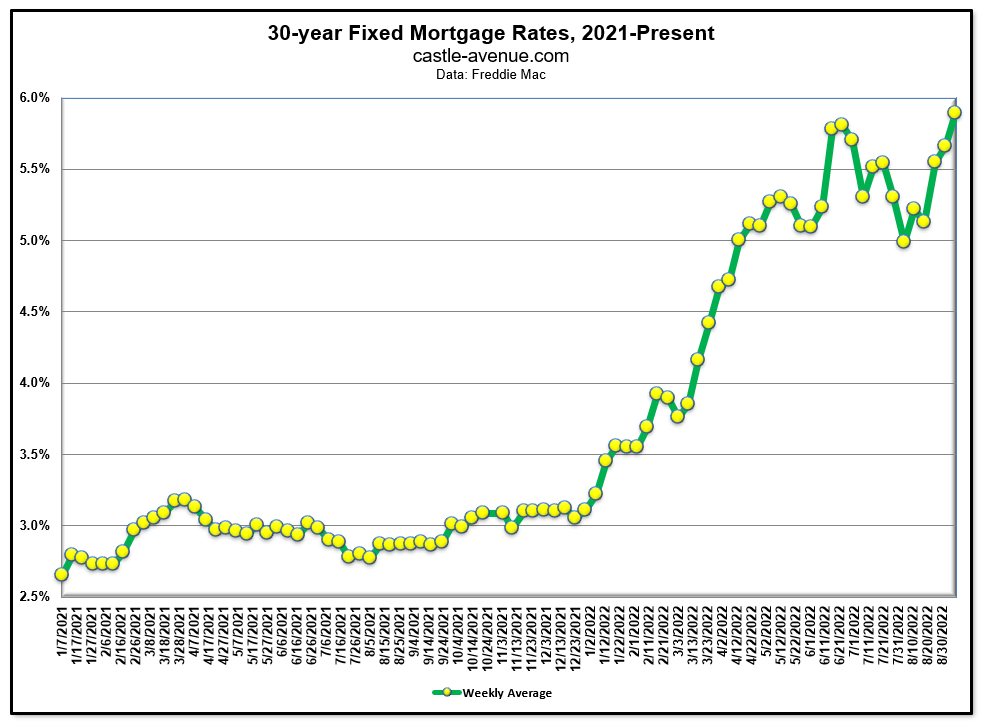

Mortgage Refinance Applications Are Collapsing What S The Impact On The Economy Markets Wolf Street

What Are Mortgage Reserves Bankrate

September 2022 Manhattan Property Market Update Wei Min Tan

90 Day Game Plan To Homeownership

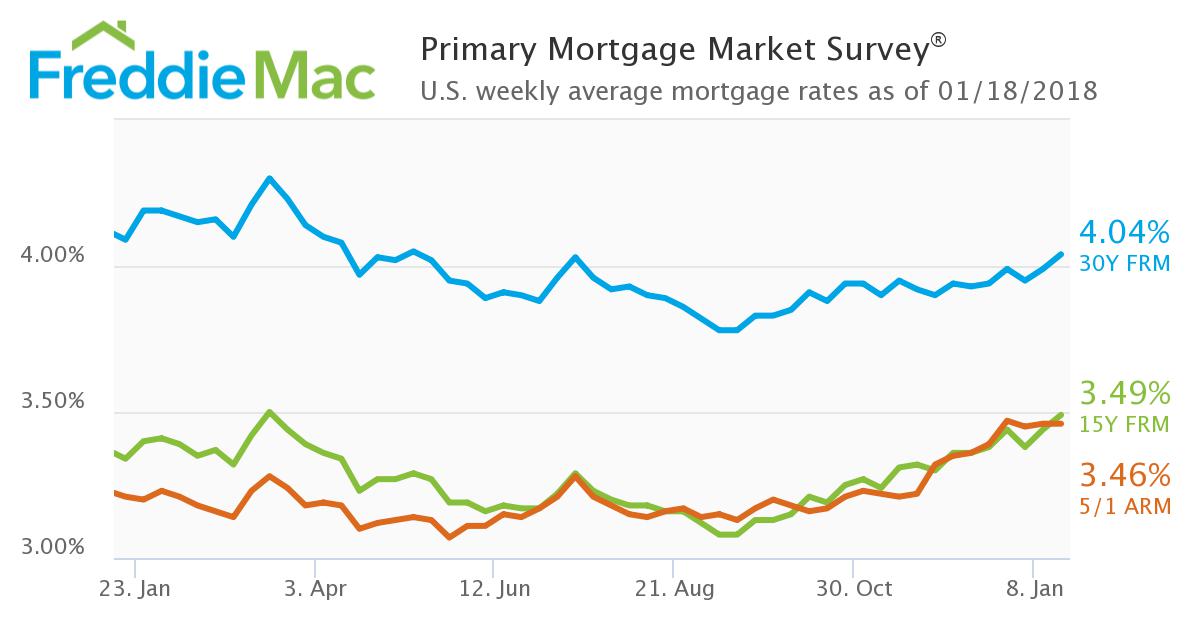

Freddie Mac Mortgage Rates Exceed 4 For First Time Since July Housingwire

Oxuvbrdcz8xsym

What Are The Reserve Requirements For Jumbo Loans

/cloudfront-us-east-1.images.arcpublishing.com/dmn/5Z6SY3NW7ZFVJA6HR4U4RYSHPU.jpg)

Mortgage Rates Rise Above 7 For First Time In Two Decades

What Are Mortgage Reserves Bankrate

What Are Mortgage Reserves Learn About Cash Reserve Requirements After Closing On Your Home Loan

Mortgage Lender Woes Wolf Street

40 Year Mortgage Veteran Com

How Does The Fed Rate Affect Mortgage Rates Discover